PRESS RELEASE TURNOVER INDEX FOR MOTOR TRADE:

1 st quarter 2017, annual increase 16.0% The Hellenic Statistical Authority publishes the turnover indices for Motor Trade with base year 2010=100.0 for the 1 st quarter 2017, according to provisional and working day adjusted data, as follows:

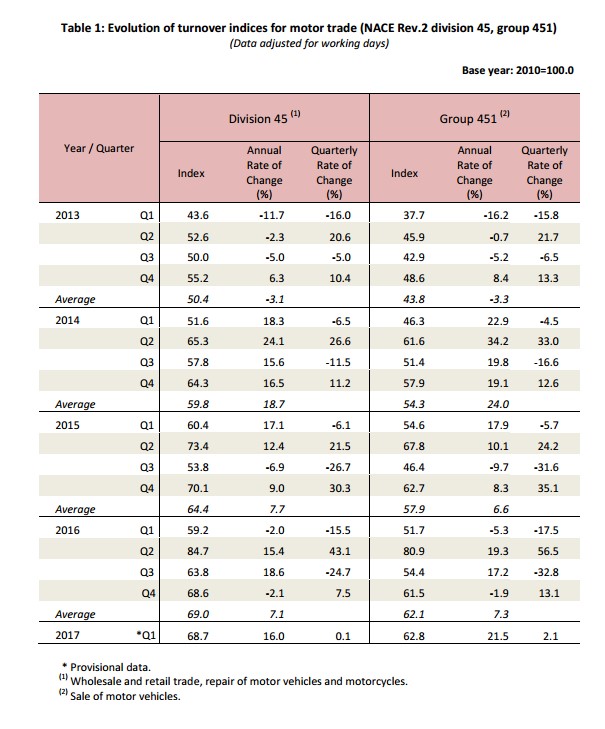

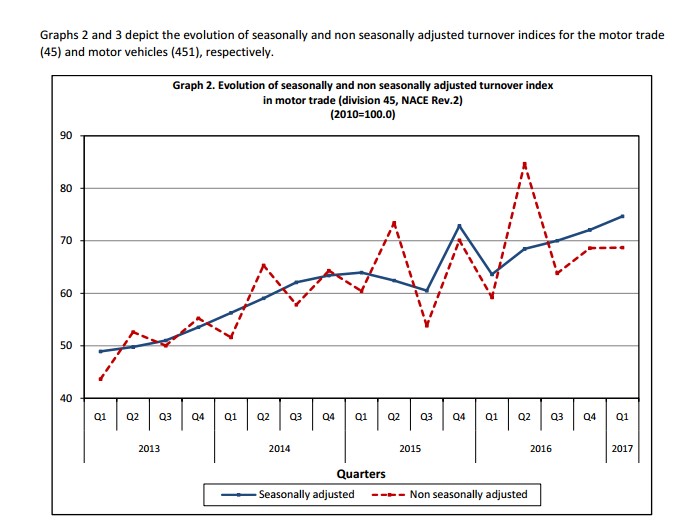

The turnover index for motor trade under division 45 (Wholesale and retail trade and repair of motor vehicles and motorcycles) of NACE Rev. 2 classification of the 1 st quarter 2017 compared with the corresponding index of the 1 st quarter 2016 increased by 16.0%, while compared with the corresponding index of the 4 th quarter 2016 increased by 0.1% (Table 1).

The turnover index for sale of motor vehicles (group 451 of NACE Rev. 2) of the 1 st quarter 2017 compared with the corresponding index of the 1 st quarter 2016 increased by 21.5%, while compared with the corresponding index of the 4 th quarter 2016 increased by 2.1% (Table 1).

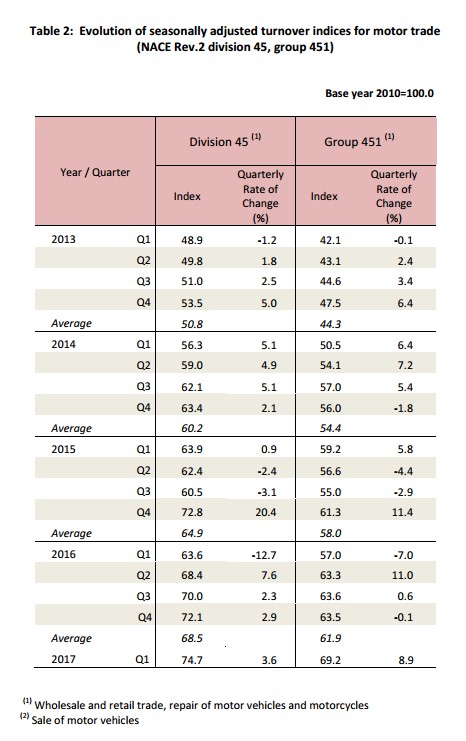

The seasonally adjusted turnover index for motor trade under division 45 of the 1 st quarter 2017 compared with the corresponding index of the 4 th quarter 2016 recorded an increase of 3.6% (Table 2).

The seasonally adjusted turnover index for motor vehicles (group 451) of the 1 st quarter 2017 compared with the corresponding index of the 4 th quarter 2016 recorded an increase of 8.9% (Table 2). It should be noted that the turnover index for motor trade (division 45) in the 4 th quarter 2016, which had been announced as provisional in the previous press release was revised from 68.7 to 68.6, due to new available information, while the previous index of group 451 was revised from 61.6 to 61.5. Therefore, the annual change of the group 450 has been revised from -2.0% to -2.1% and the group 451 from -1.8% to -1.9%.